Apple Card - First Impressions

The Apple ecosystem is strong, and it just got a heck of a lot stronger. Enter the Apple credit card, downstage right. My first impressions of using the card directly at the Apple Store, using Apple Pay for lunch, in mobile apps, and swiping the physical card, I’m already able to see the benefits that this brings to the table. No other card has this implementation down. You can really tell the entire card was built from the customer experience and worked backwards from there.

Let’s talk about the minimum requirements to start to sign up for Apple Card.

-First and foremost - you must have an iPhone! That’s right, the way to sign up for Apple Card at the time of writing this post is that you do so from iPhone. 📱

-Like any other card you must be at least 18 years of age and be a US Citizen.

-Your iPhone must be running at least iOS 12.4

-Your iPhone must have a passcode enabled.

-Lastly you must have Two Factor Authentication enabled on your Apple ID and signed into iCloud on that device.

If you do not have that enabled you will be presented with a dialogue box like this. I can’t stress enough the importance of Two Factor Authentication, so if you do not have that enabled please get it enabled ASAP for your accounts.

https://support.apple.com/en-us/HT204915

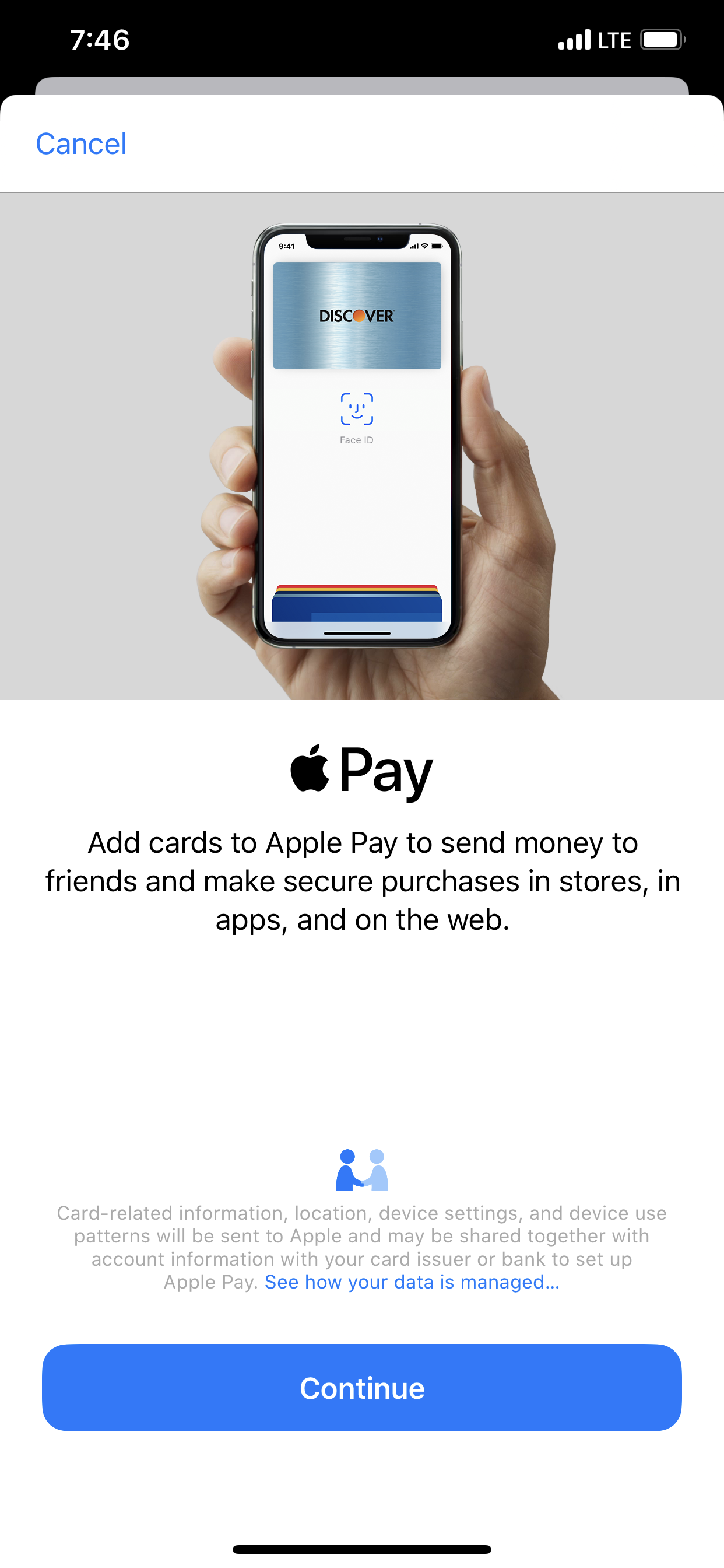

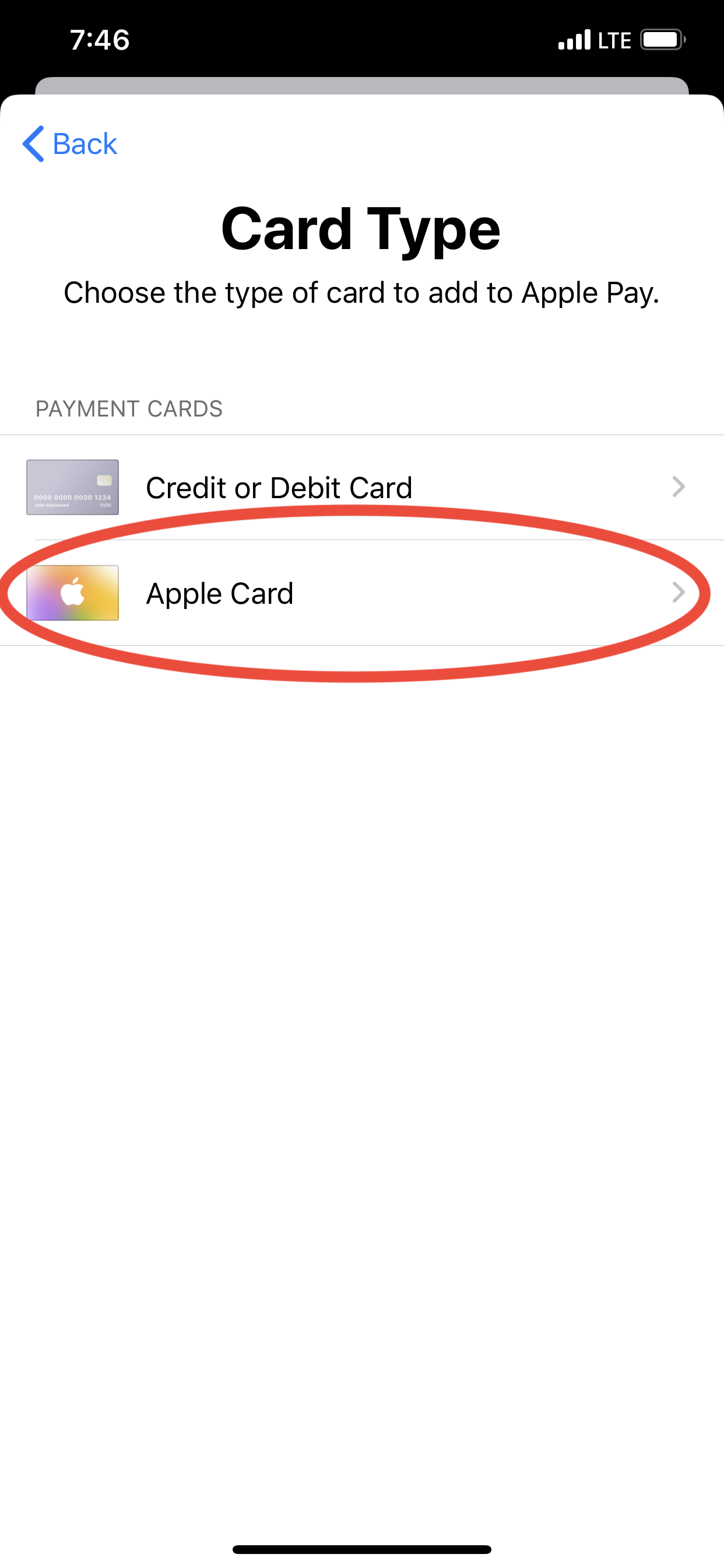

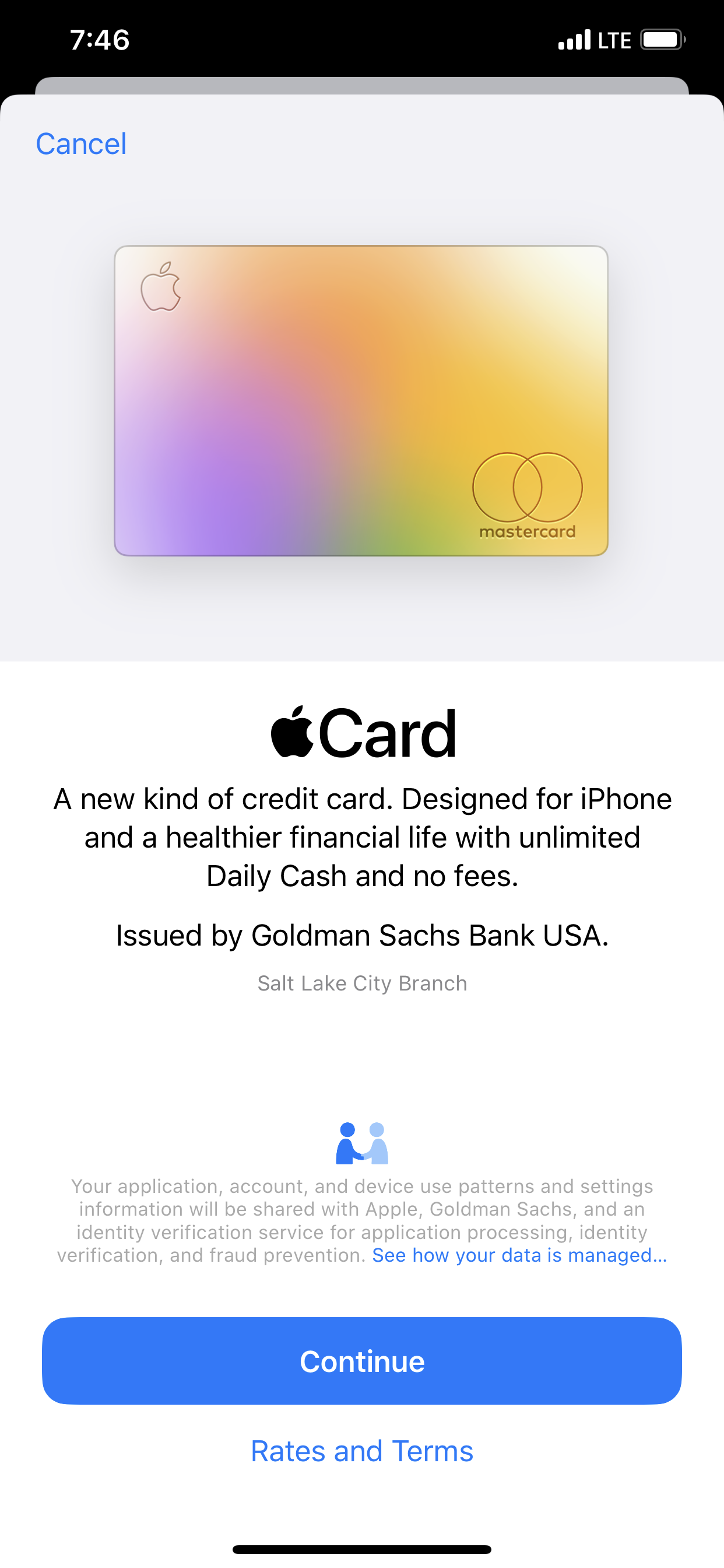

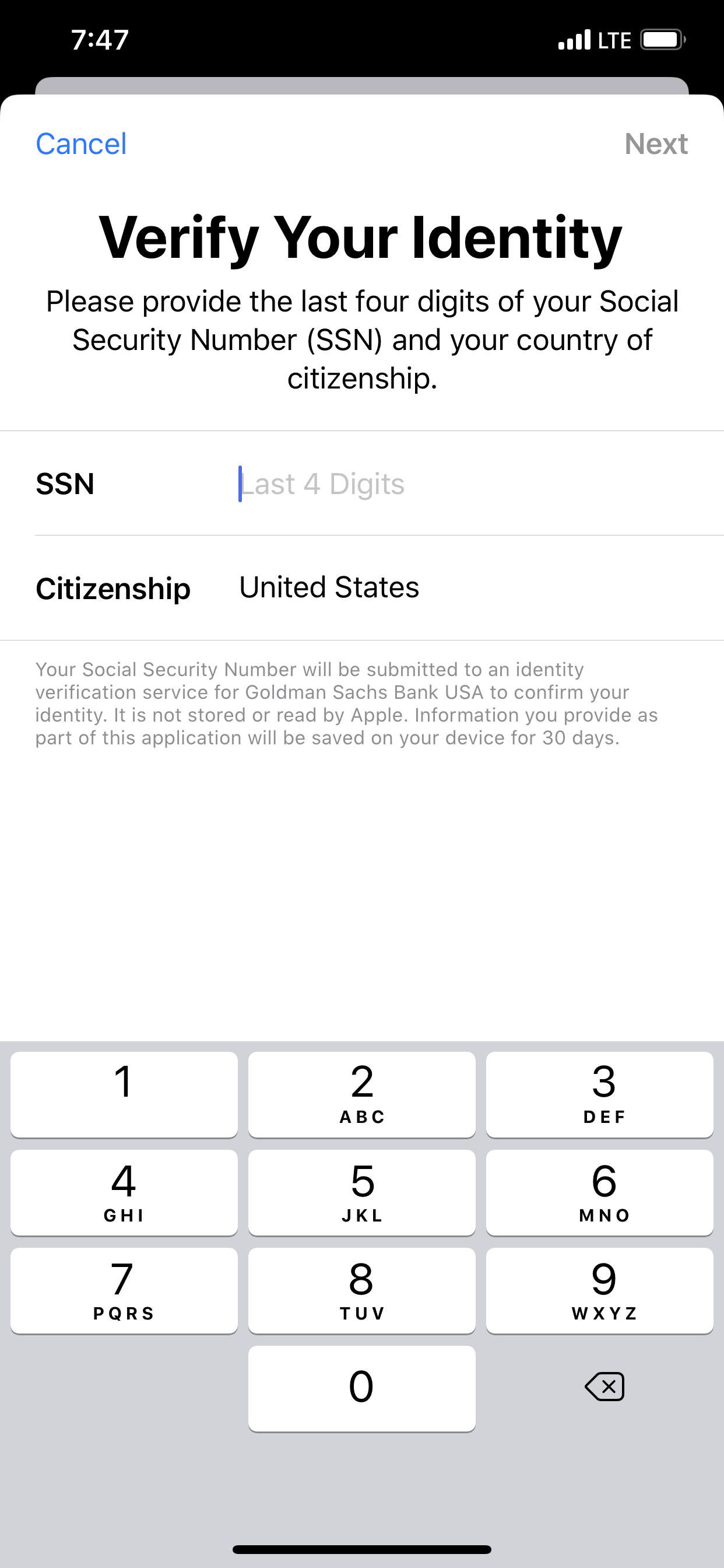

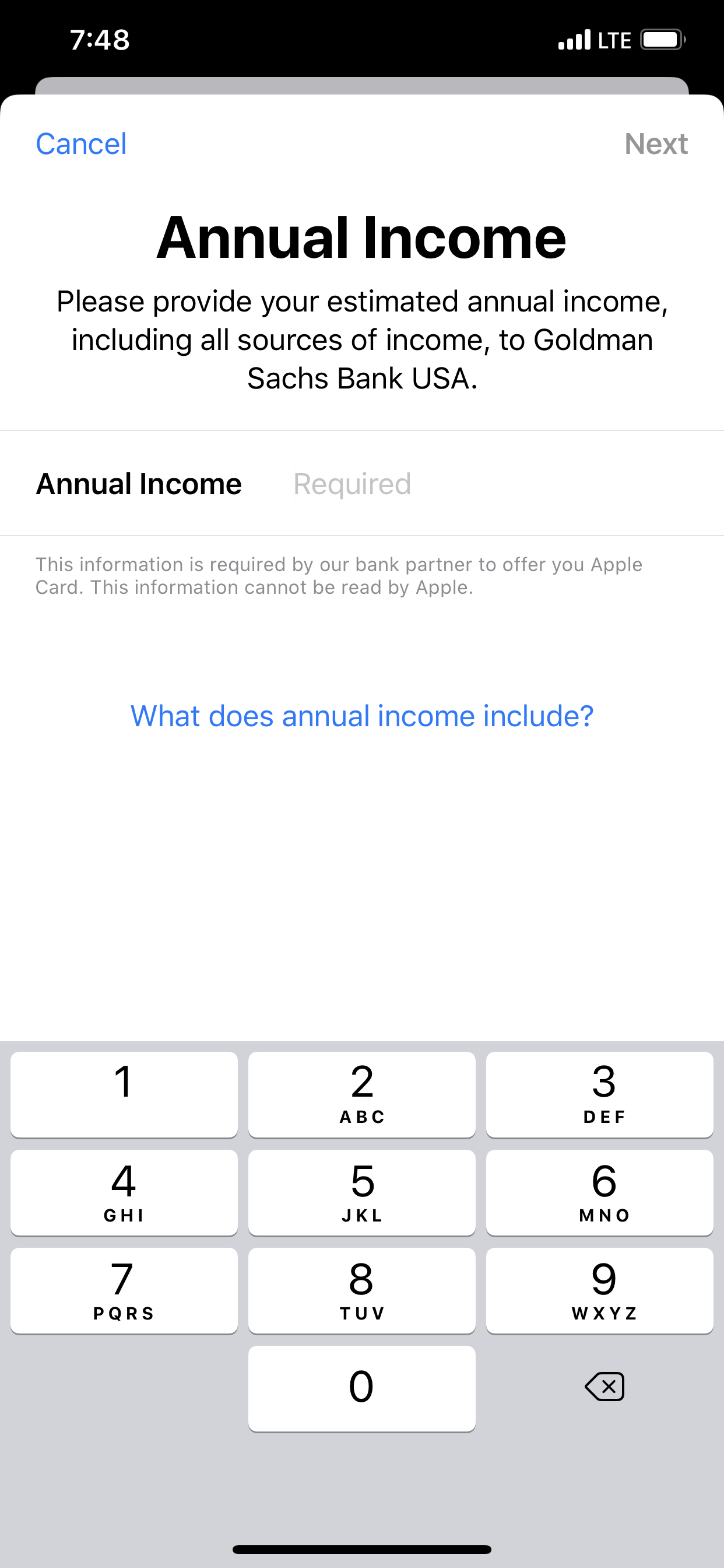

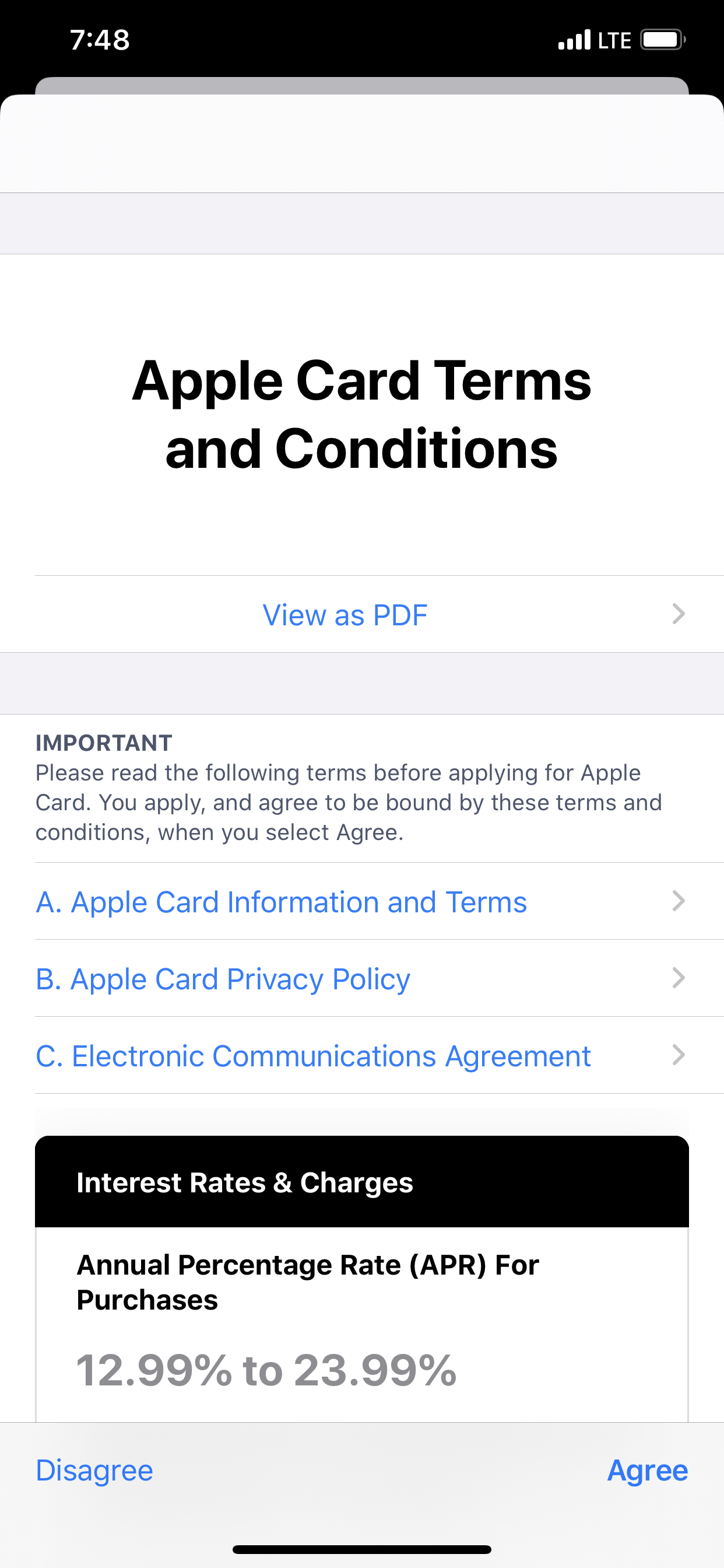

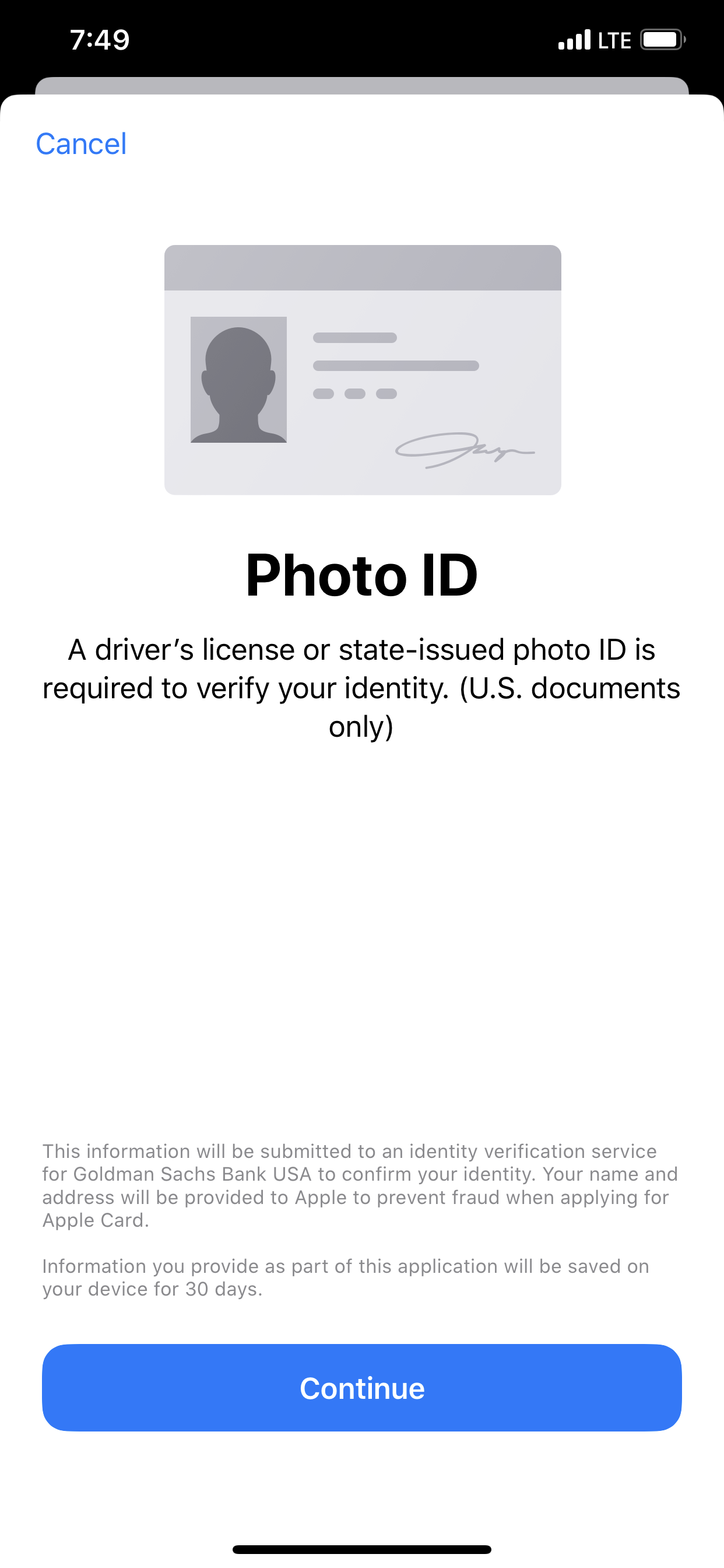

All righty, let’s start with the sign-up experience. In this case it is super simple. To sign up for Apple Card launch the Wallet App on iPhone, tap the Plus Button upper right, and from the menu options select “Apple Card”. From there you will follow along the prompts entering information such as your name, date of birth, phone, address, last 4 of your SSN, annual income, etc. Basically the standard “credit card sign up information” that all banks require. One of the last steps is you need to take a photo of the front and back of your Photo ID. Apple classifies that as a “driver’s license or state-issued photo ID” in the US.

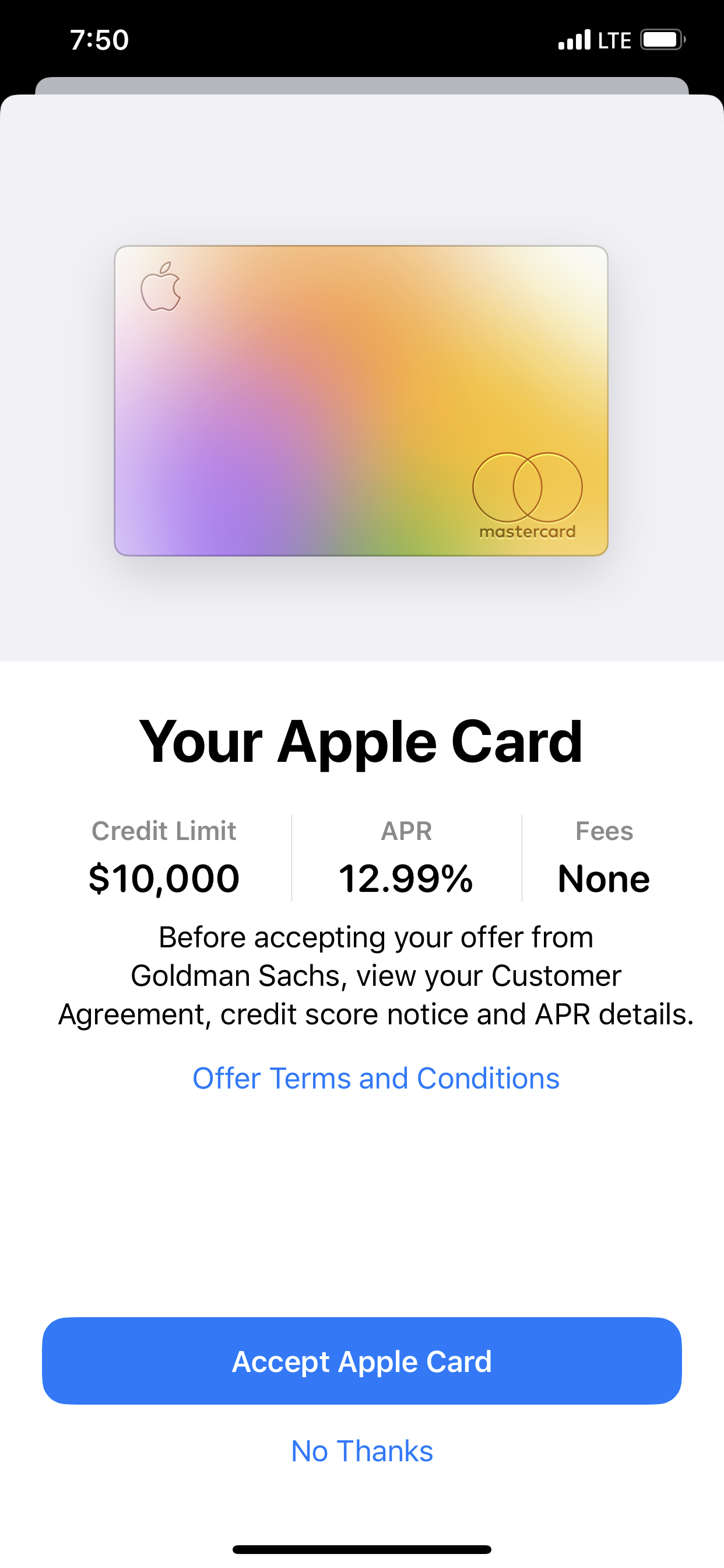

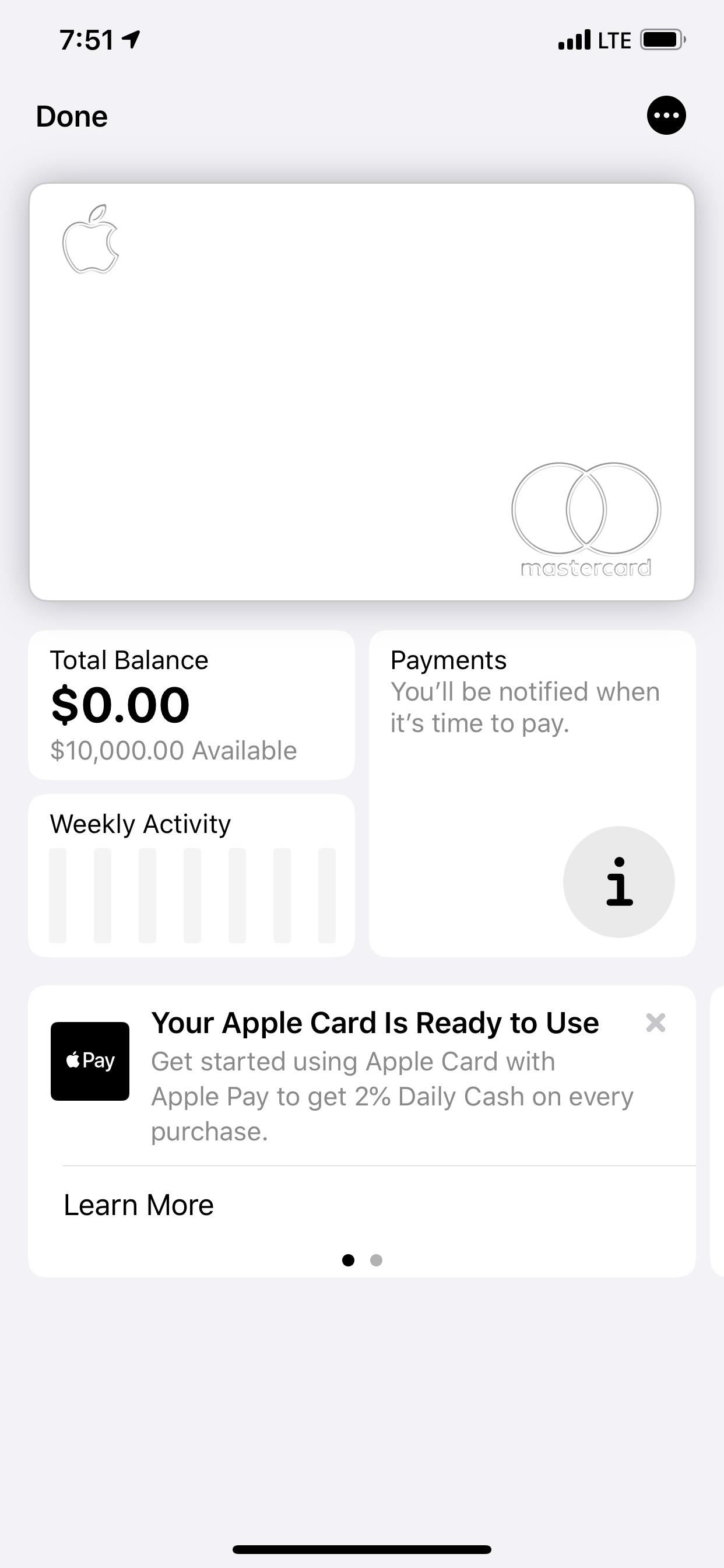

Within a few seconds you will find out if you have been approved for Apple Card. This card is a MasterCard backed by Goldman Sachs, which was a smart move by Goldman who will immediately acquire an entire new demographic of clientele. If you are approved you also get the option to get an insanely cool looking pure white titanium card sent to your home. That arrived for me about a week after I was approved. (Apple says about 6-8 days)

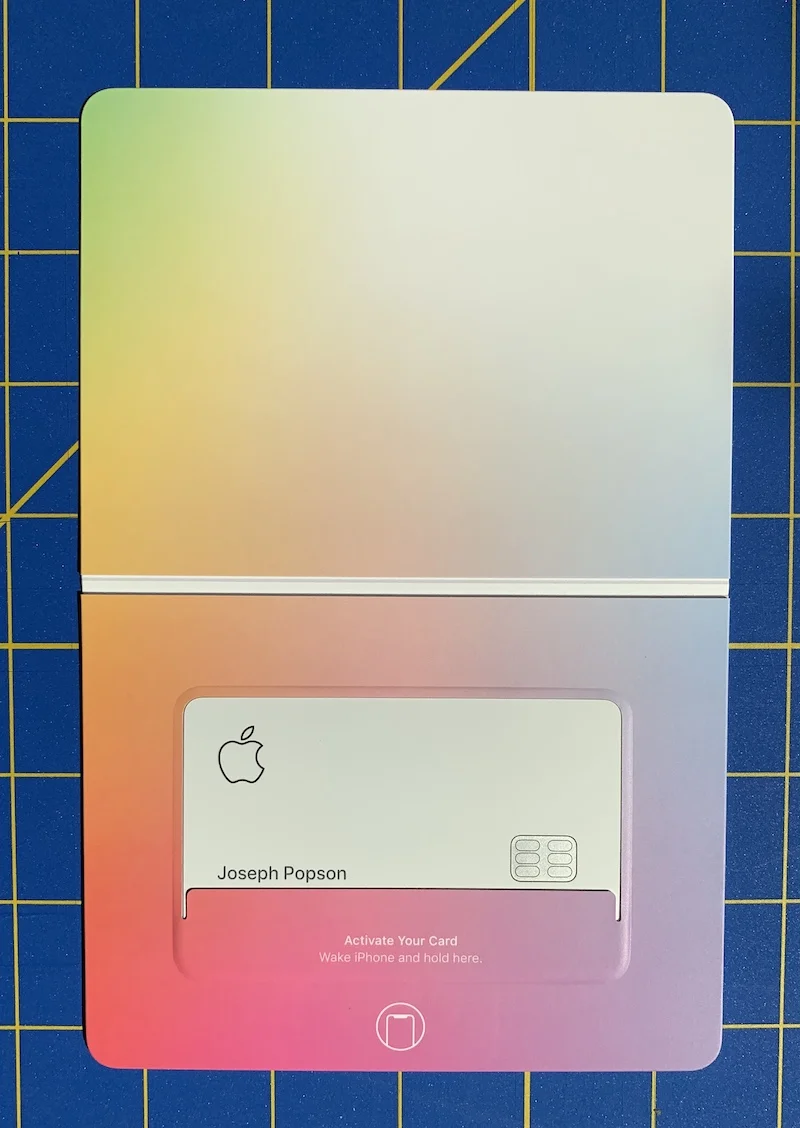

Take notice to this card, as it doesn’t even have your credit card number printed on it. Activating this card with the Wallet App is also insanely cool. You simply have your iPhone unlocked and place the credit card in the holder it shipped in near your iPhone, and it activates with one tap. Another nod to the “Think Different” movement to do things in a more secure and different way.

Physical Card Activation

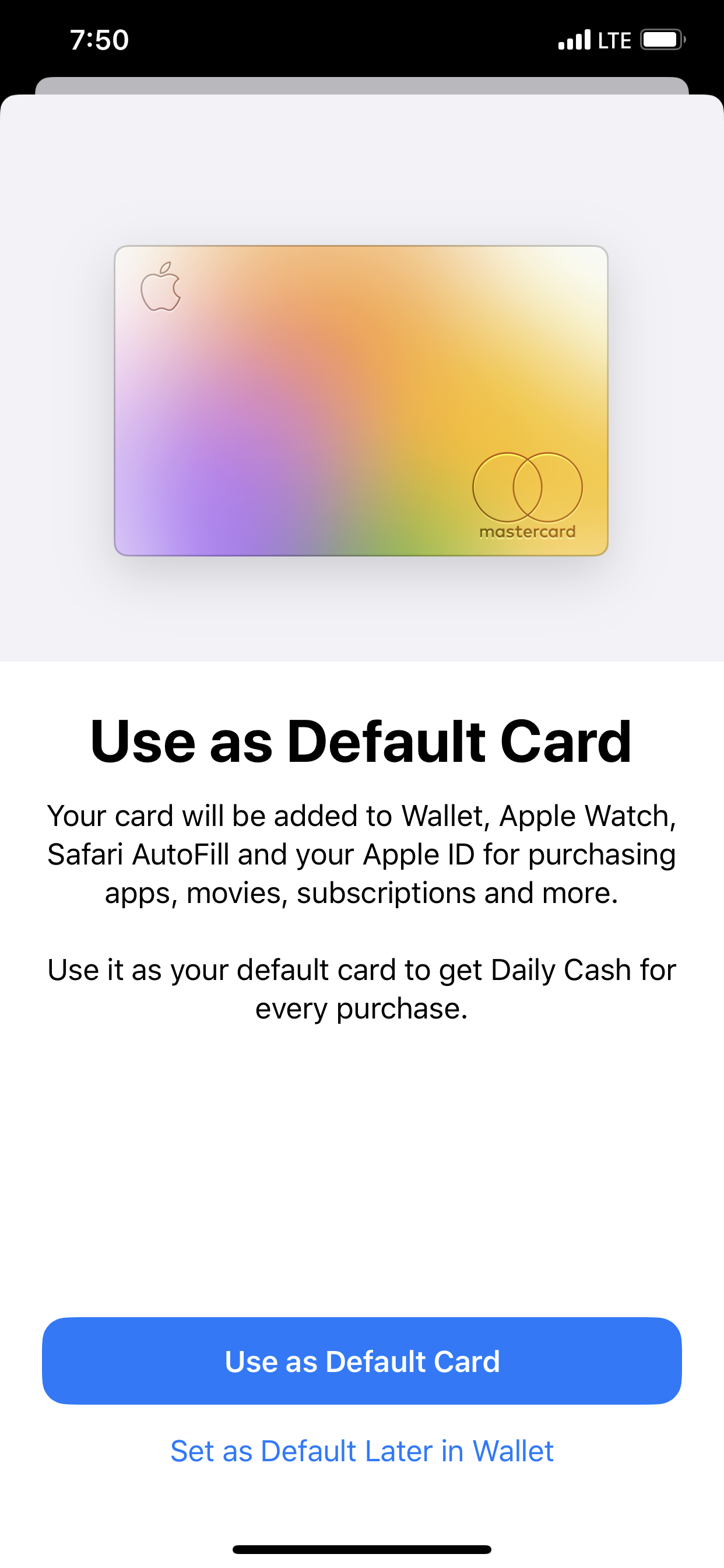

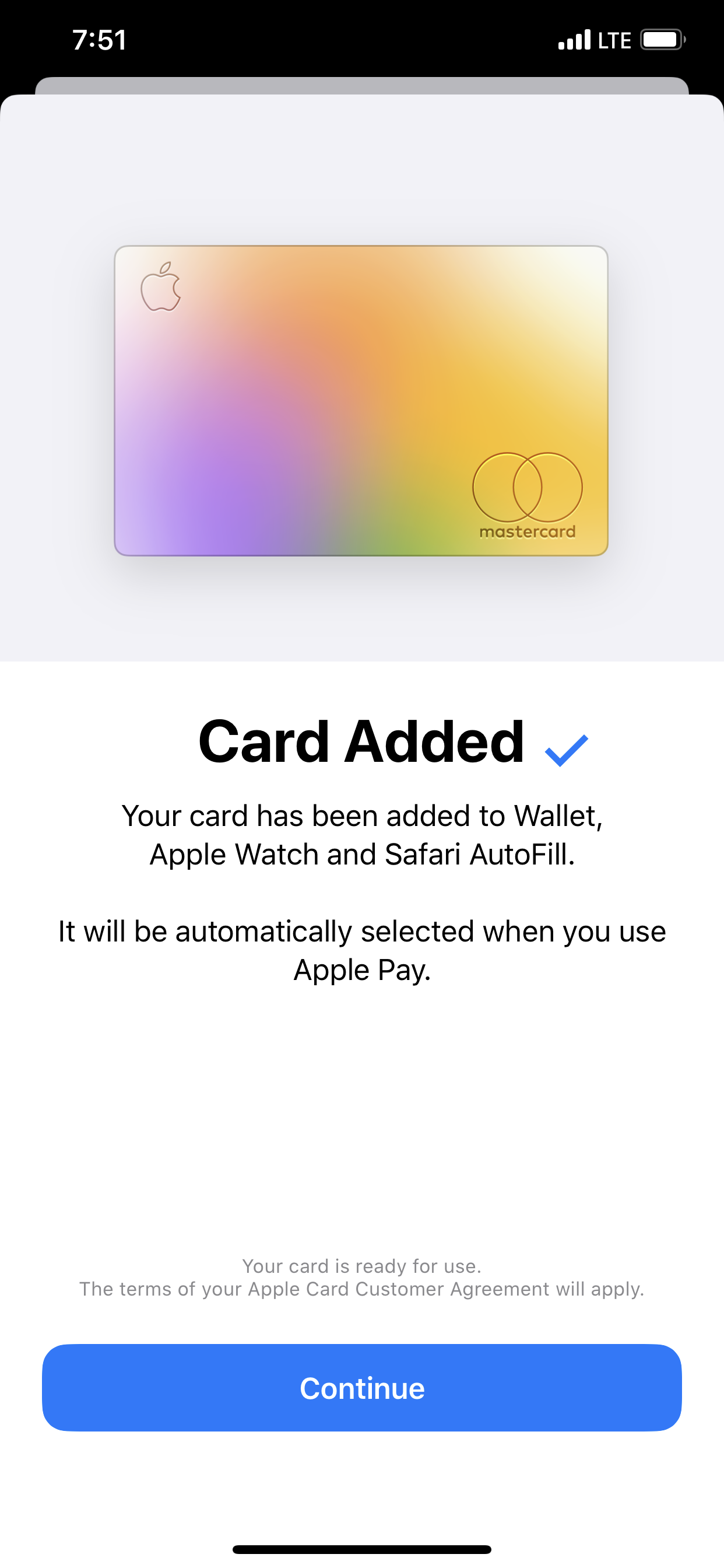

Back in your Wallet App Apple will give you a prompt on your iPhone asking if you want your newly approved Apple Card to be the “Default Card” in your iPhone wallet. Now let’s think about this. This is where Apple really gets to continue controlling the experience. If you select to do this anything you pay for with Apple Pay will be charged to your newly approved Apple Card. It will be the primary card that is displayed. This goes for payments on your iPhone, Apple Watch, iPad, and Mac. We’ll be getting to iPad and Mac in a bit.

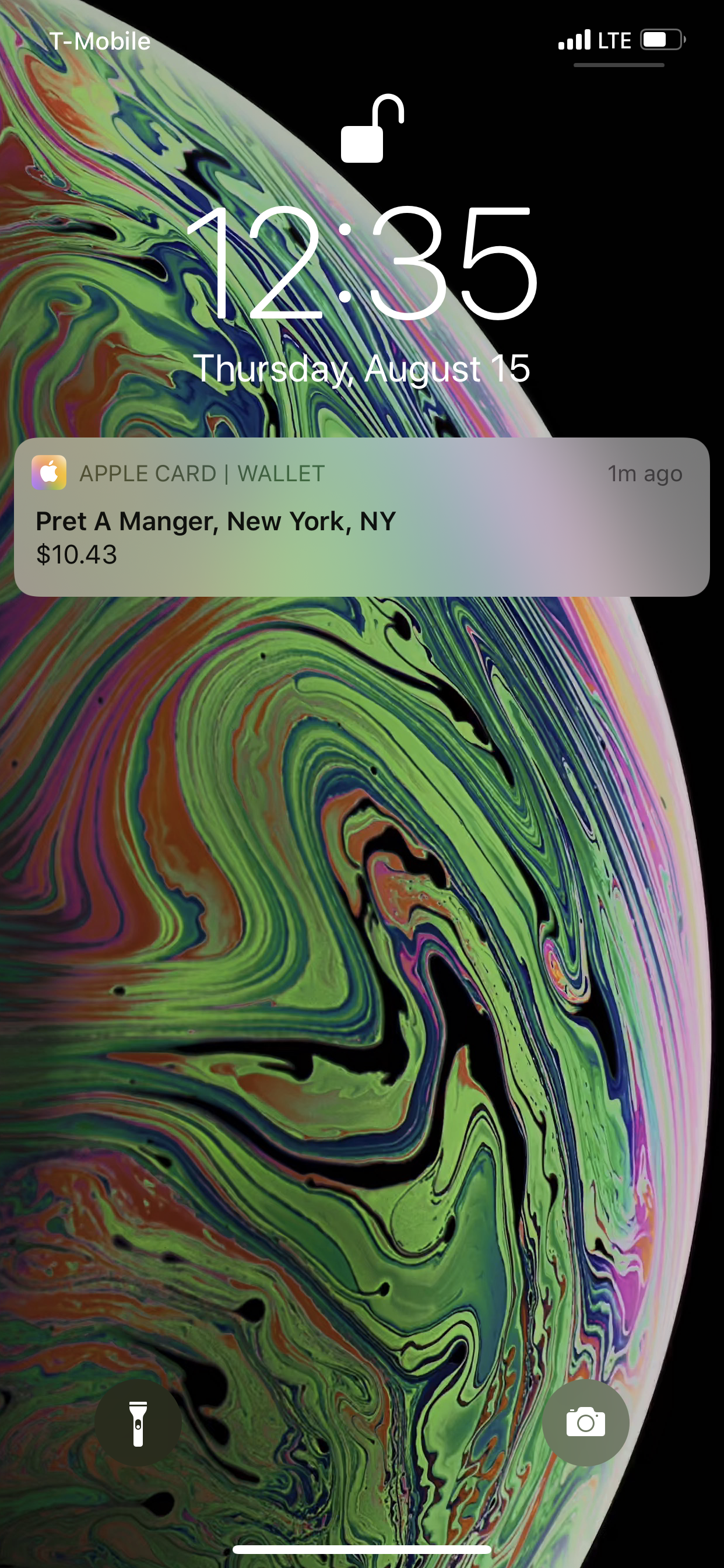

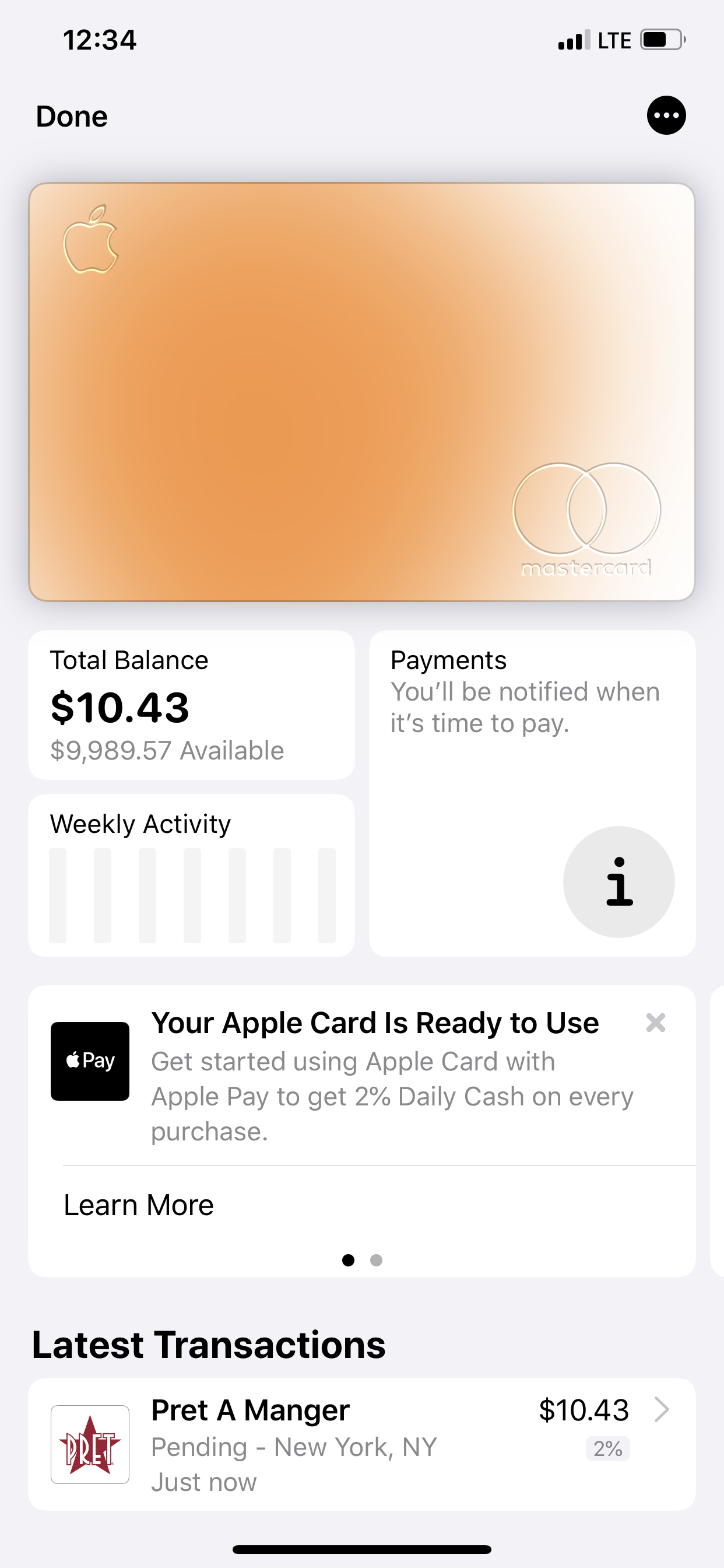

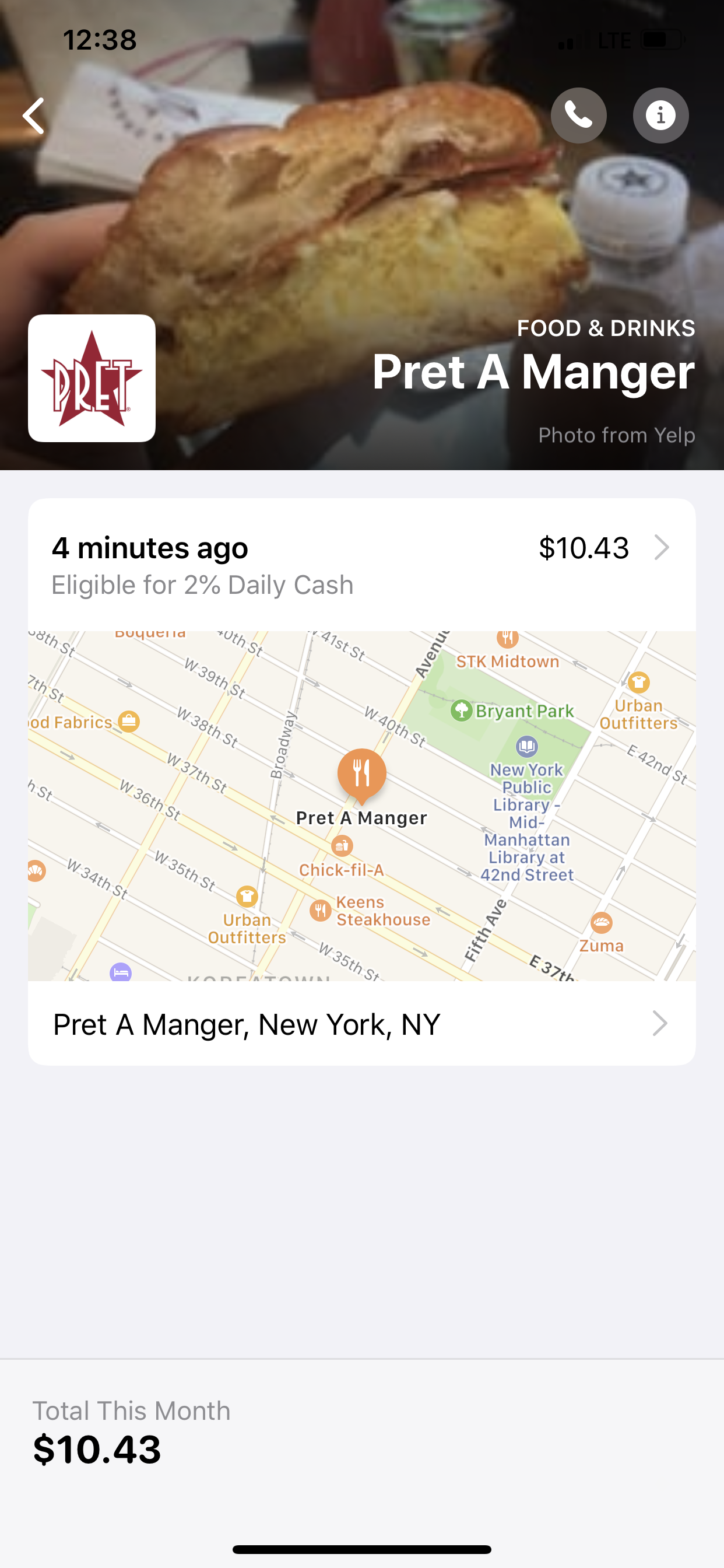

Immediately after getting approved for Apple Card you can start using it, so I did just that. Now before I used it, I noticed this next opportunity Apple has here. The Apple Card is pure white in your Wallet app. That is because I have 100% of my balance available. I went out to grab a bite to eat during my lunch break from work and went to Pret a Manger in Manhattan. As usual, I used Apple Pay when checking out and got my food. No big difference with that. The difference was that because I used Apple Card I got a notification on my device immediately in the form of a push notification and an update in my Wallet app. I also noticed the logo from the transaction was branded to match up with Pret a Manger’s company logo. I went one step further and tapped into the charge and noticed that Apple dropped a pin on the map to have full visibility into when and where the transaction took place. In addition to that, I noticed immediately after my first transaction my all white Apple Card, had now just turned orange. What in the world is going on here? I had an idea that Apple was up to another integration of one app informing the other, so when I tapped the Apple Maps location to see on the map where I bought my lunch, it dawned on me. Apple has specific colors set to locations in Apple Maps. Check them out here. This means Apple Card has set out to compartmentalize purchases not only in categories, but in colors that correlate back to Apple Maps location groupings. 🤯

People are going to find satisfaction in watching their card change colors, but I do believe that users will find excitement in paying the card down to zero and watching the card that was compartmentalized in colors turn back to pure white. The pure white card goes back into the old Apple way of thinking. Why was the original iPod white? Why was the iMac white? Why was the iBook white? Why were the Apple EarPods and now AirPods white? Steve Jobs wanted these pieces of tech to be looked at not as tech, but as pristine pieces of art. They want their pieces to be approachable, and have a consistent vision across their product line of hardware, software, and now services. You can read more about why Steve Jobs and Jony Ive chose white in the Walter Isaacson book on p.390 ‘The Whiteness of the Whale’.

You can add the Apple Card to your iPad and Mac as well to use with purchases either on a MacBook Pro or MacBook Air with Touch ID, and iPad with Touch ID or Face ID. To add it on Mac go to Apple Logo upper left — System Preferences —Wallet & Apple Pay — Add Card.

On iPad navigate to Settings — Wallet & Apple Pay — and Add Card. Once the card is added this is where you can see your transaction history.

iPad must also be on iOS 12.4 and the Mac must be macOS Mojave 10.14.6 or higher.

Now let’s dig into a bit more of the benefits. First off there are no international transaction fees. Secondly, with Apple Card you get back “Daily Cash” into your wallet. So 24 hours after you spent money on the card you will get a percentage back that you can use in Apple Cash. You can use that to pay for something via Apple Pay, use to send to a friend, and you can even use that instant cash to go towards your balance. So for all purchases you will get back:

1% All purchases or any purchase done with the physical card or the card number.

2% Anything purchased using Apple Pay.

3% Anything bought at the Apple Store using Apple Pay.

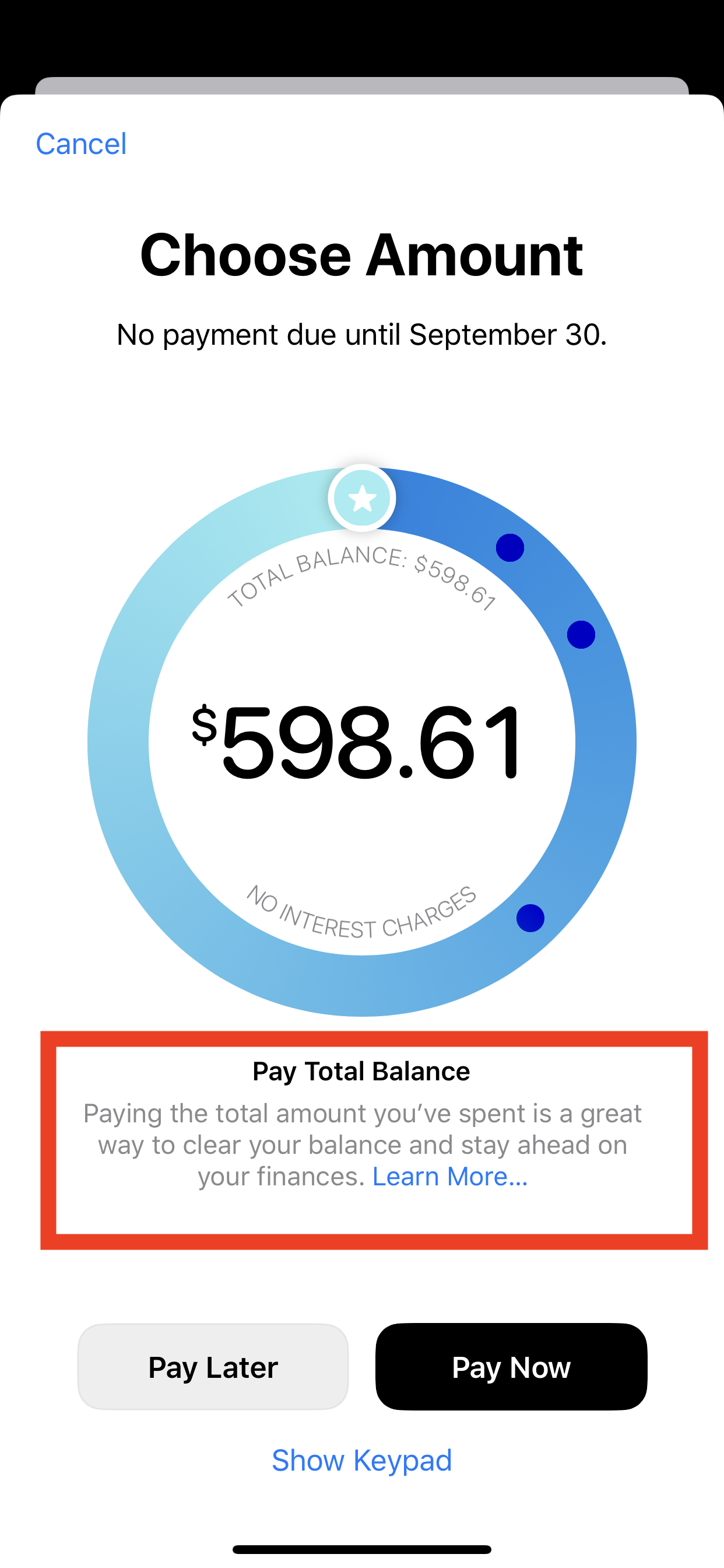

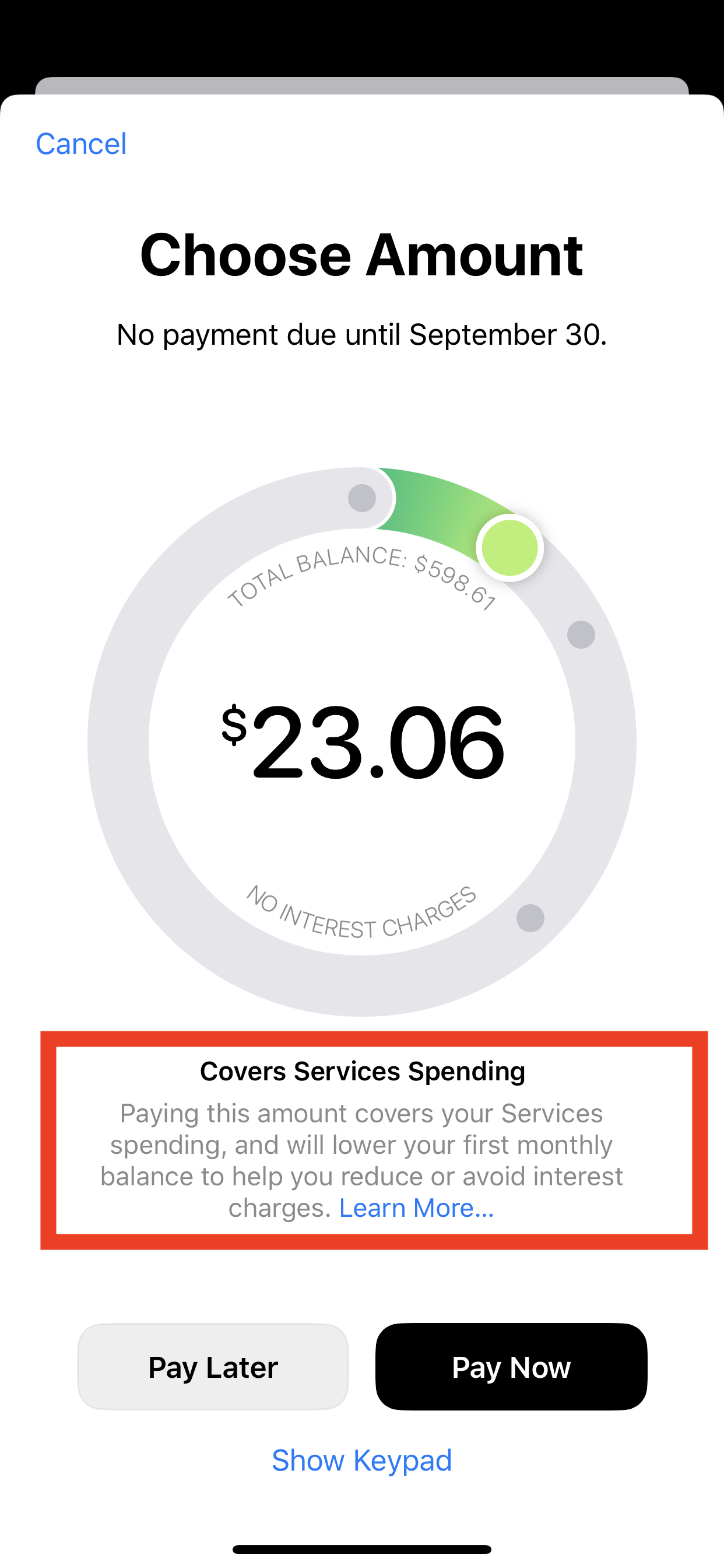

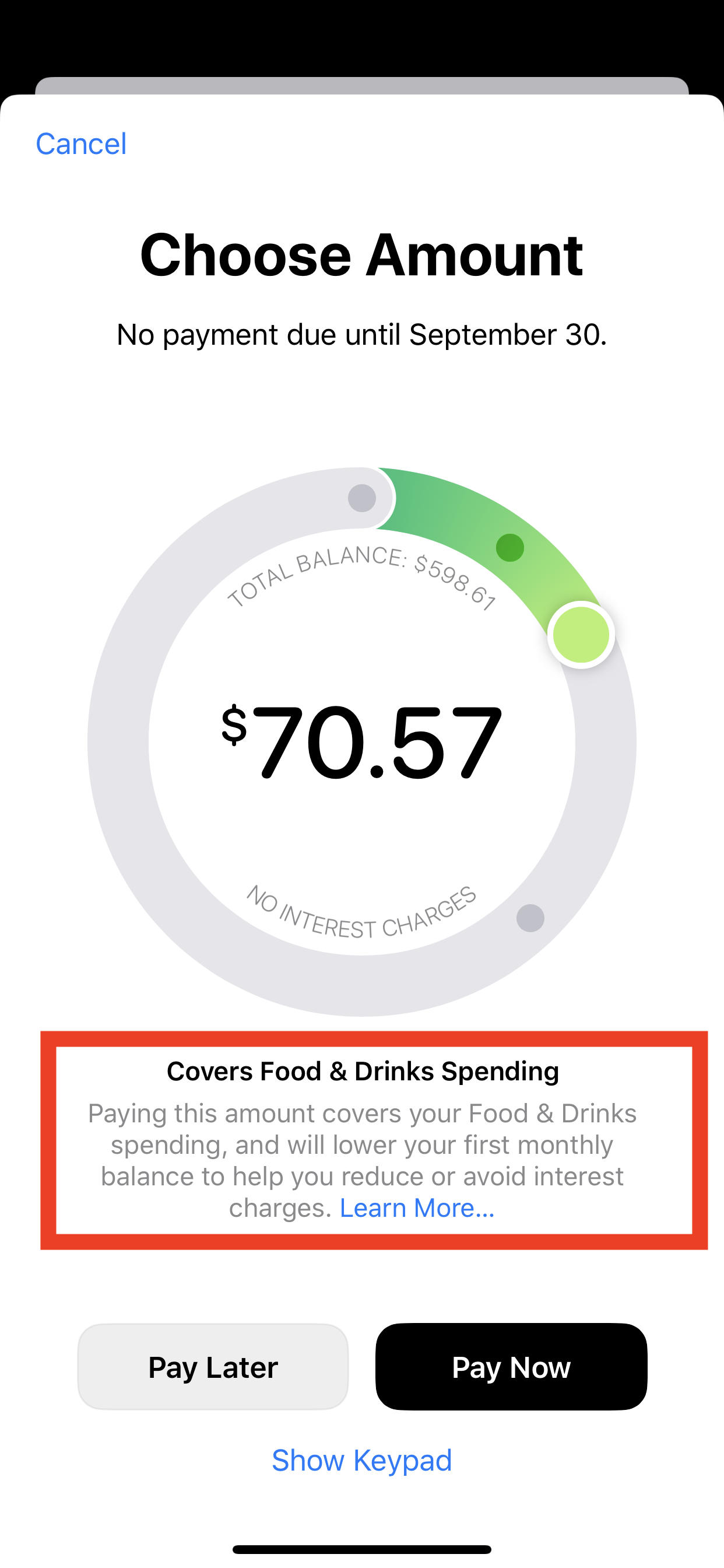

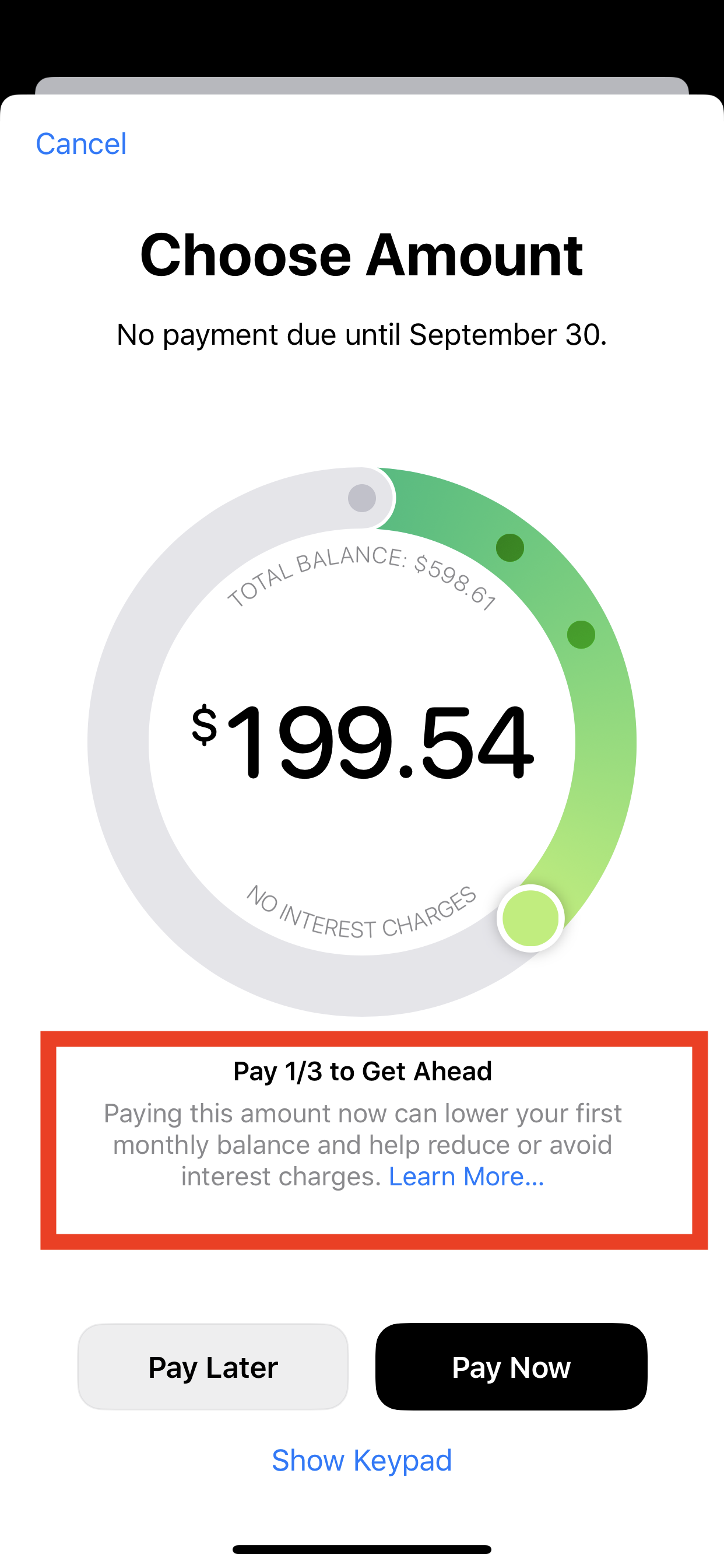

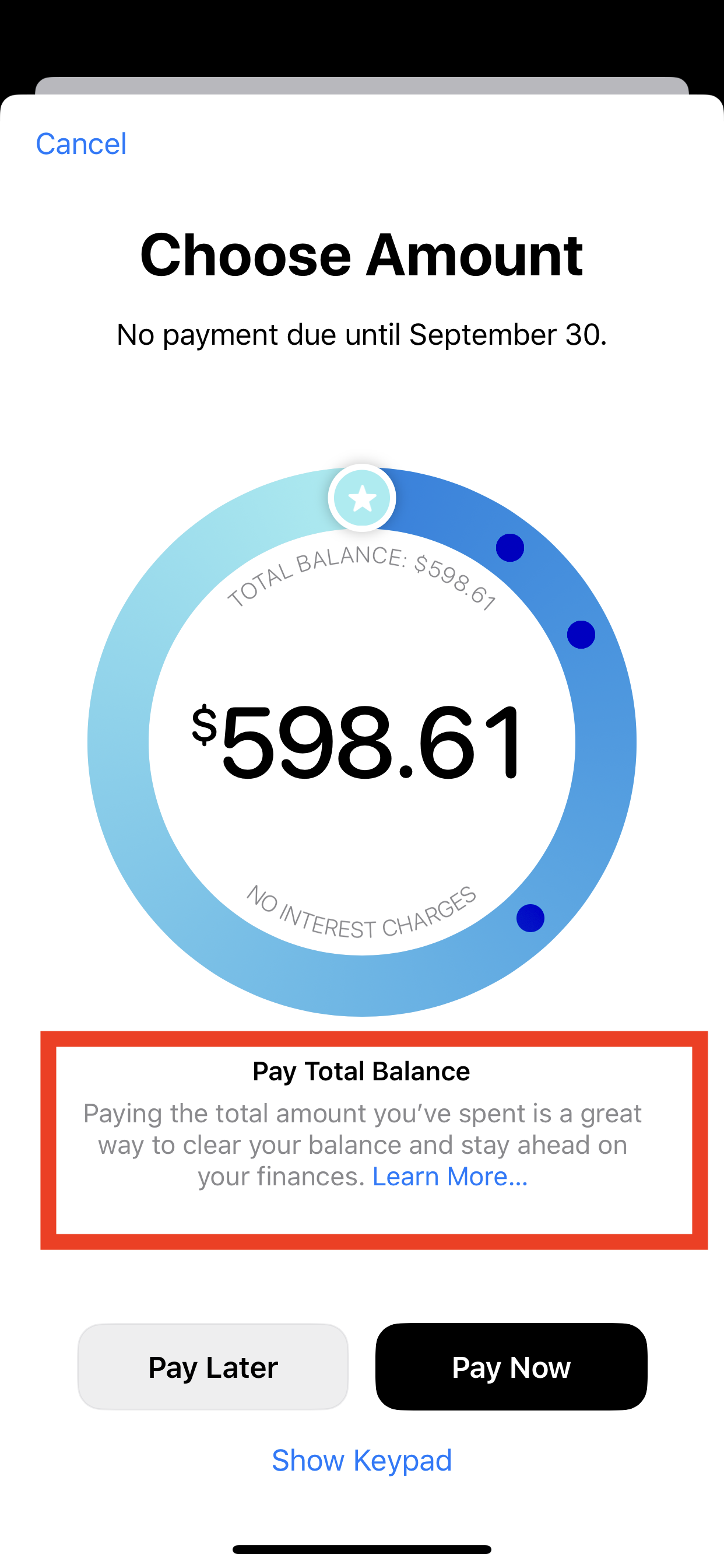

I paid down the card 100% and immediately after paying the balance in full the card went back to pure white. I also applied my $11.33 to the balance from my Apple Daily Cash. I thought it was quite clever how the app visually shows you the breakdown of how much you spent in Services or Food & Drink. The card also goes as far as to give you payment information and guidance on how much you need to pay to be 1/3 ahead of payments.

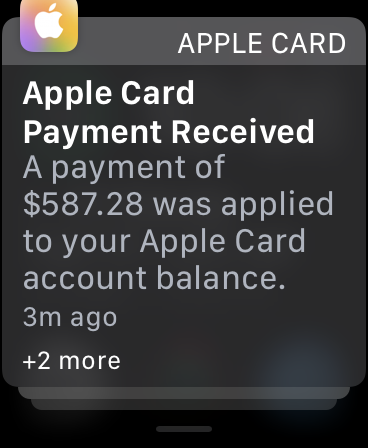

Apple also gives you FULL visibility when you make a payment as all devices that have Apple Card on it will get a push notification letting you know the payment was made.

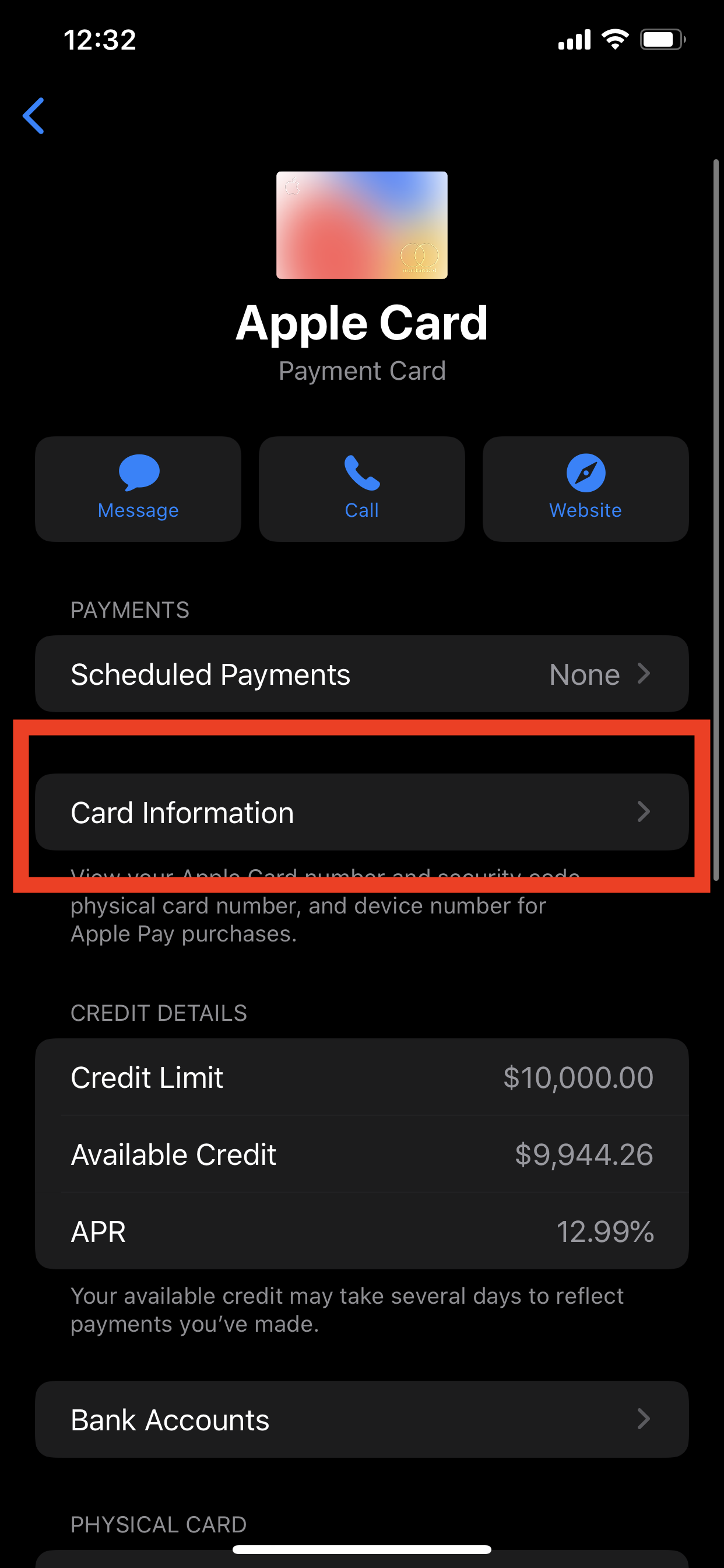

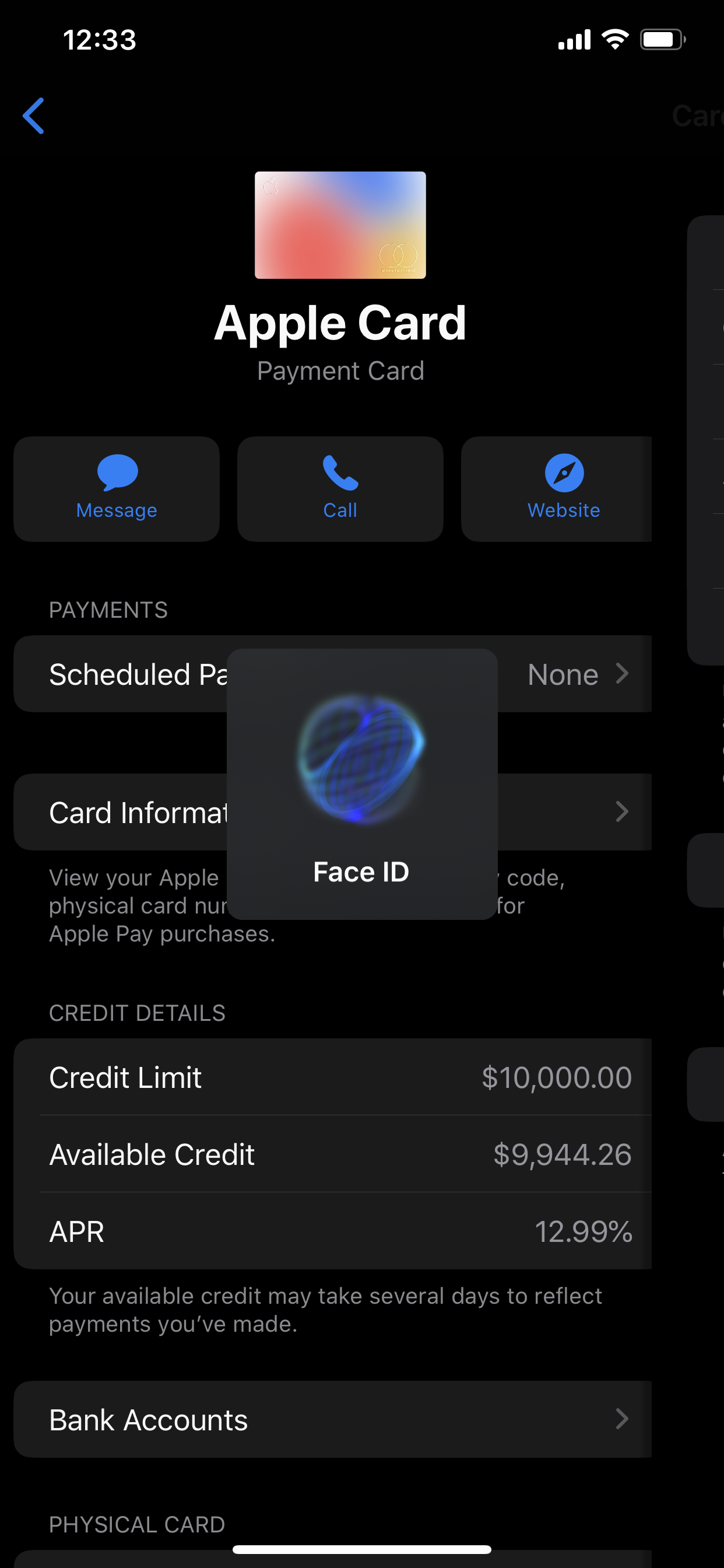

If there is a situation that you want to use the actual credit card number for a purchase, you can find it here in Wallet App. Select the three dots upper right, tap card information, authenticate with Face ID, and there it is. Number, Expiration, Security Code. and of course Network which is Mastercard. I love that it’s so deeply embedded into the Wallet App and secured with Face ID authentication on iPhone. The security of this card is a main feature for users to appreciate.

Although the Apple Card doesn’t give as many rewards or percentage back on certain purchases than other credit card options, Apple Card is here to stay. Apple has yet again taken an industry that all ready existed and made it better, more approachable, and more accessible for users. I predict the card will evolve as all Apple products do, and we’re just seeing the beginning as to where Apple Card will go. Another win for Apple to ensure the ecosystem is here to stay. Please spend responsibly! 💳

-Joe